Futures

Bitget futures: Iceberg order

2024-10-16 03:3042108

The iceberg order is a strategic approach to placing large trades, effectively mitigating market impact and slippage. This automated strategy splits large orders into smaller sub-orders, allowing for faster market entry and minimizing slippage.

Iceberg orders enable users to reduce market impact without revealing the full size of their position, making it an ideal tool for market makers. Its automatic order-splitting feature helps conceal trading intentions, making it perfect for traders who wish to keep their orders private.

Iceberg orders are currently available for perpetual futures and delivery futures (regular accounts or multi-assets accounts).

Iceberg orders do not freeze account assets. When an iceberg order is triggered, if a sub-order exceeds the maximum allowable open quantity, the order will fail, and the iceberg order will be terminated.

Key advantages

-

Hide order size: Iceberg orders can hide the total order size, with only a small portion being filled at a time.

-

Limit price support: Users can set upper and lower price limits, providing better control over order execution in dynamic market conditions.

-

Reduce market impact: Iceberg orders help prevent significant price fluctuations and front-running, making them ideal for large traders.

How does iceberg order work?

When placing an iceberg order, traders first set the total order quantity, split settings, order preferences, and price limits. Once submitted, the first sub-order enters the order book. As each sub-order is executed, the system automatically places the next one until the entire iceberg order is filled.

Split settings:

-

Quantity per order: Set the quantity for each sub-order.

-

Number of split orders: Define how many sub-orders the iceberg order will be divided into.

Order preferences:

-

Faster execution: Ensures each order is placed at the best price, adjusting continuously with market changes for optimal execution.

-

Fixed distance: Set a distance from the best bid and ask prices to maintain a consistent gap from the market spread. The order price will adjust with market changes to ensure a better execution price.

-

Supports percentage settings.

-

Supports absolute distance settings.

-

-

Fixed price: Each sub-order is placed at a fixed price.

Notes

-

Both the main account and sub-accounts support iceberg orders.

-

Each account can place up to 10 iceberg orders, with a maximum of 10 orders for USDT-M Futures, Coin-M Futures, and USDC-M Futures, respectively.

-

Only one iceberg order can be placed per futures trading pair.

-

Iceberg orders remain valid for 7 days after placement. After this period, the order will be terminated, and all unfilled sub-orders will be canceled.

Reasons for cancellation and termination of iceberg orders

There are several reasons why an iceberg order may be canceled or terminated:

-

Insufficient available balance, causing the order to fail.

-

Manual termination by the user.

-

Insufficient remaining positions.

-

The strategy has expired.

-

Order placement is not permitted during delivery.

-

Opening new positions is restricted as the delivery date approaches.

-

The current maximum openable position exceeds the limit set by risk control. Please contact customer service if you have any questions.

-

Order quantity exceeds the maximum position size.

-

Account is abnormal or frozen.

-

Minimum order value limit has been triggered.

How to place an iceberg order?

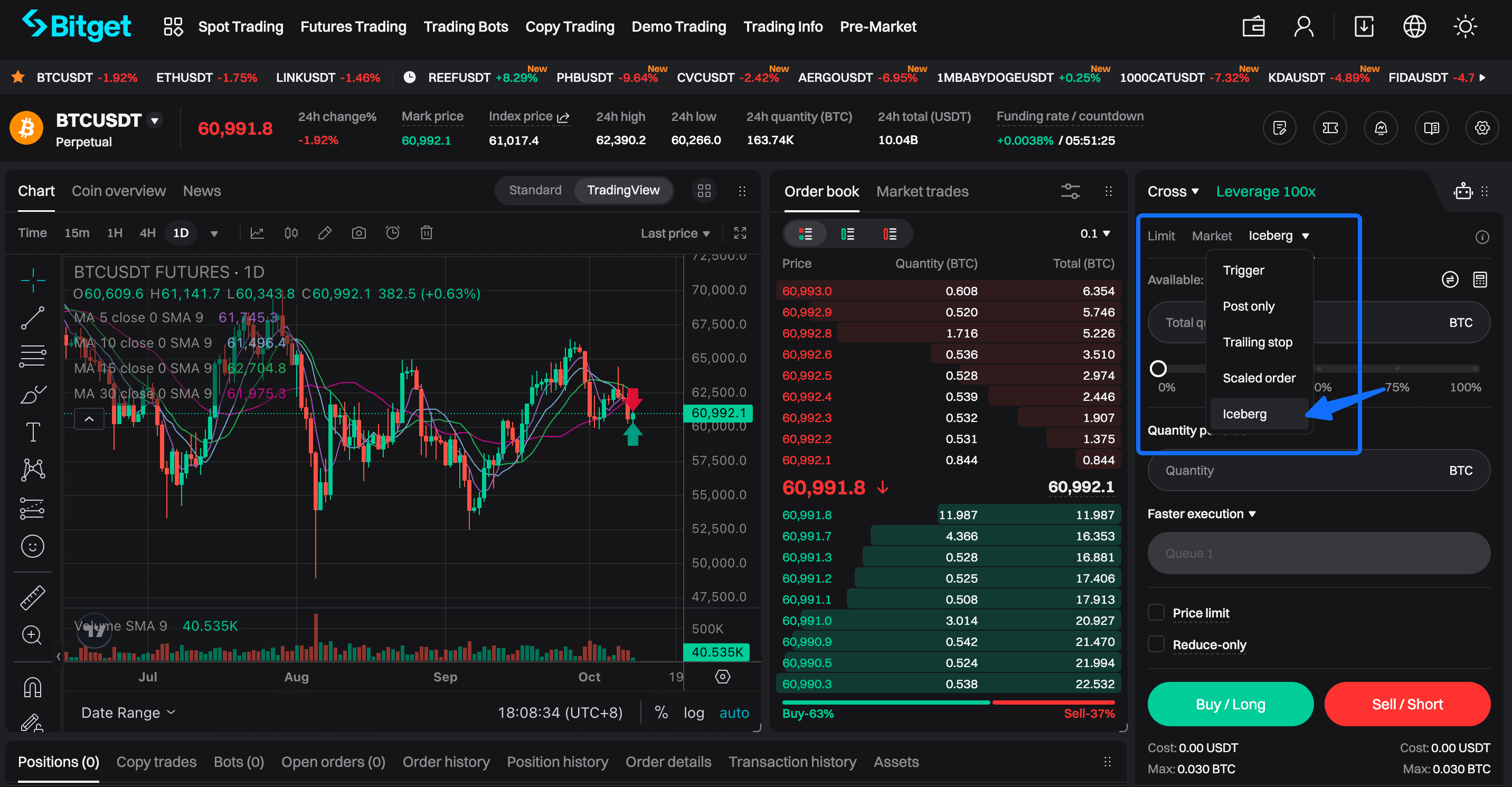

Step 1: Navigate to the futures trading page and select "Iceberg" as the order type in the order placement section.

Step 2: Set and enter the order parameters.

-

Total quantity

-

Split settings: Quantity per order or Number of split orders.

-

Order preferences: Faster execution, Fixed distances, or Fixed price.

-

Set price limit

-

Finally, click the "Buy/Long" button or the "Sell/Short" button to place the order.

Step 3: View current or historical orders. Use the "Open orders" or "Order history" button and select "Iceberg" to see the main order details and any terminated sub-orders. You can choose "Limit | Market" to view the details of the iceberg sub-orders.

Note:

-

TP/SL is not supported for iceberg sub-orders.

-

If any sub-orders are canceled, the main order will also be canceled and terminated.

Join Bitget, the World's Leading

Crypto Exchange and

Web 3 Company

Share